Solutions

Make smarter investment decisions, faster.

Industries

Asset managers

Challenge estimations, analyse your competitors, assess growth potential and much more.

Brokers & Consultants

Advise on acquisitions, investments, or renovations faster with Quanthome’s data, supporting your decisions every step of the way.

Wealth managers

Integrate real estate into your analysis for a complete 360° view of your clients' portfolios.

Public institutions

Gain deeper insights into your local market, launch large-scale research projects, and effectively monitor public policy.

Use cases

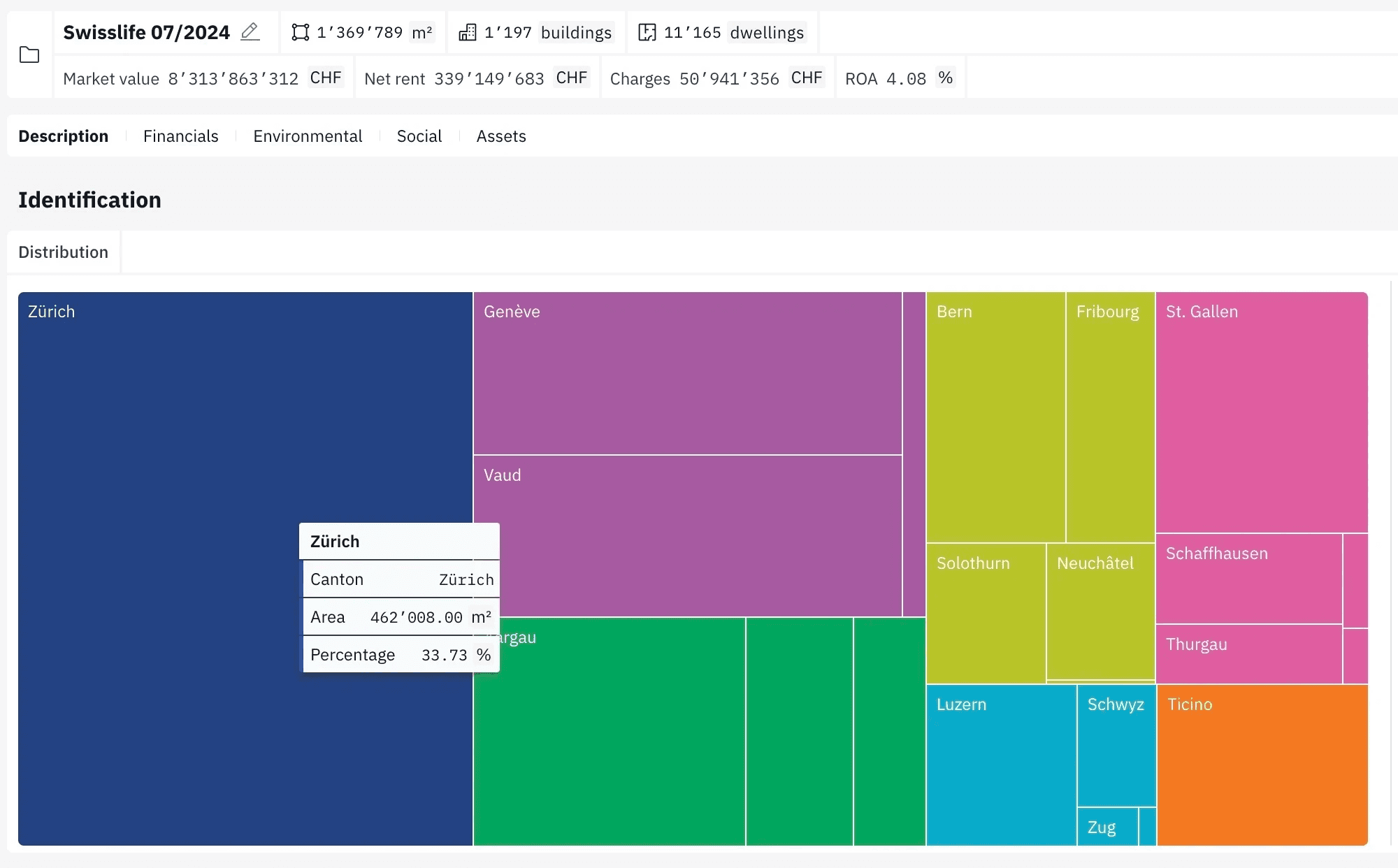

Portfolio reporting

& Risk management

As an asset manager, consolidate your portfolio, automate your risk assesment, find arbitrage opportunities and trade the agio.

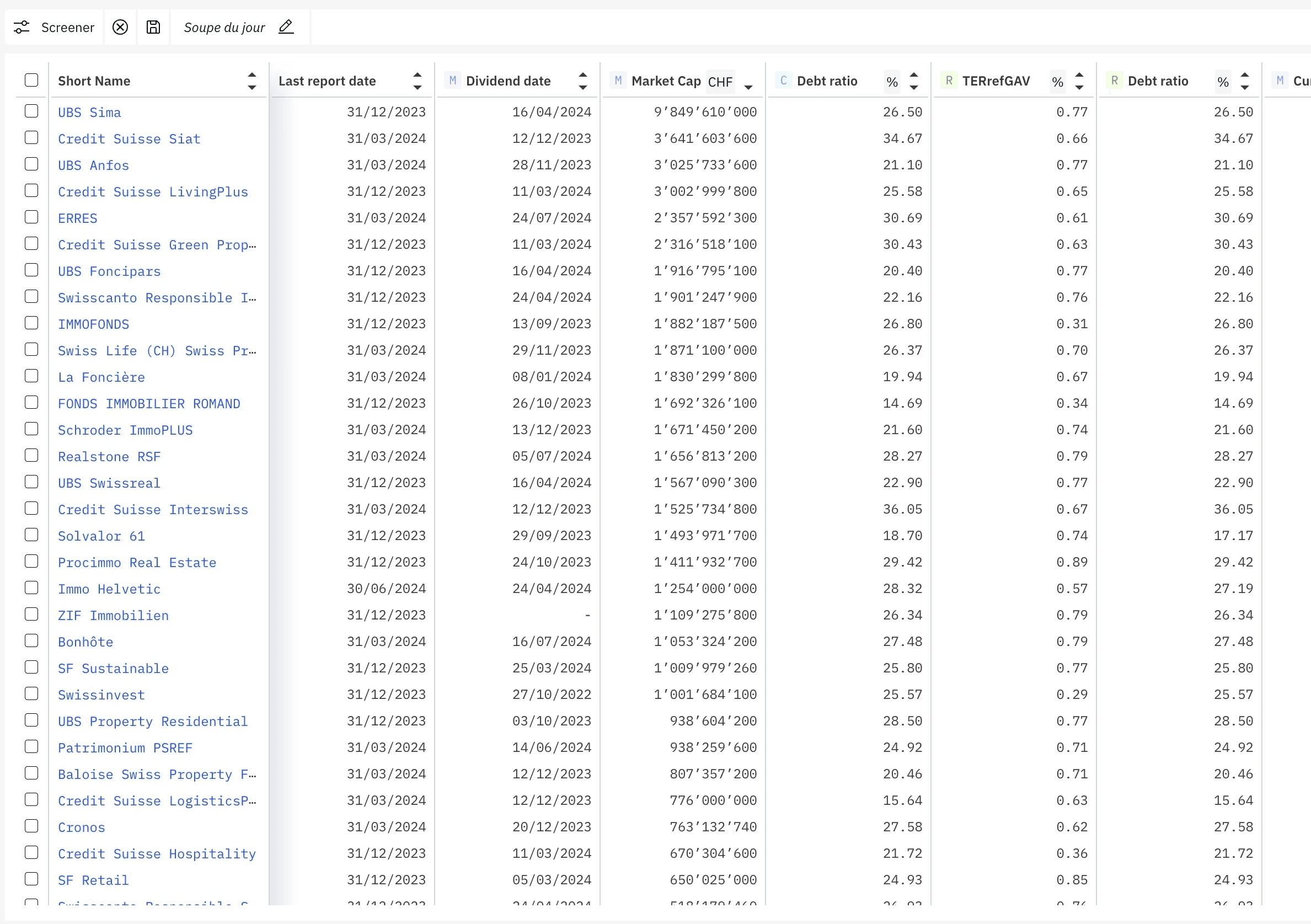

Funds selection

Analyse hundreds of key metrics in seconds, from standardised ratios to performance and inventory data, and make informed investment choices with ease.

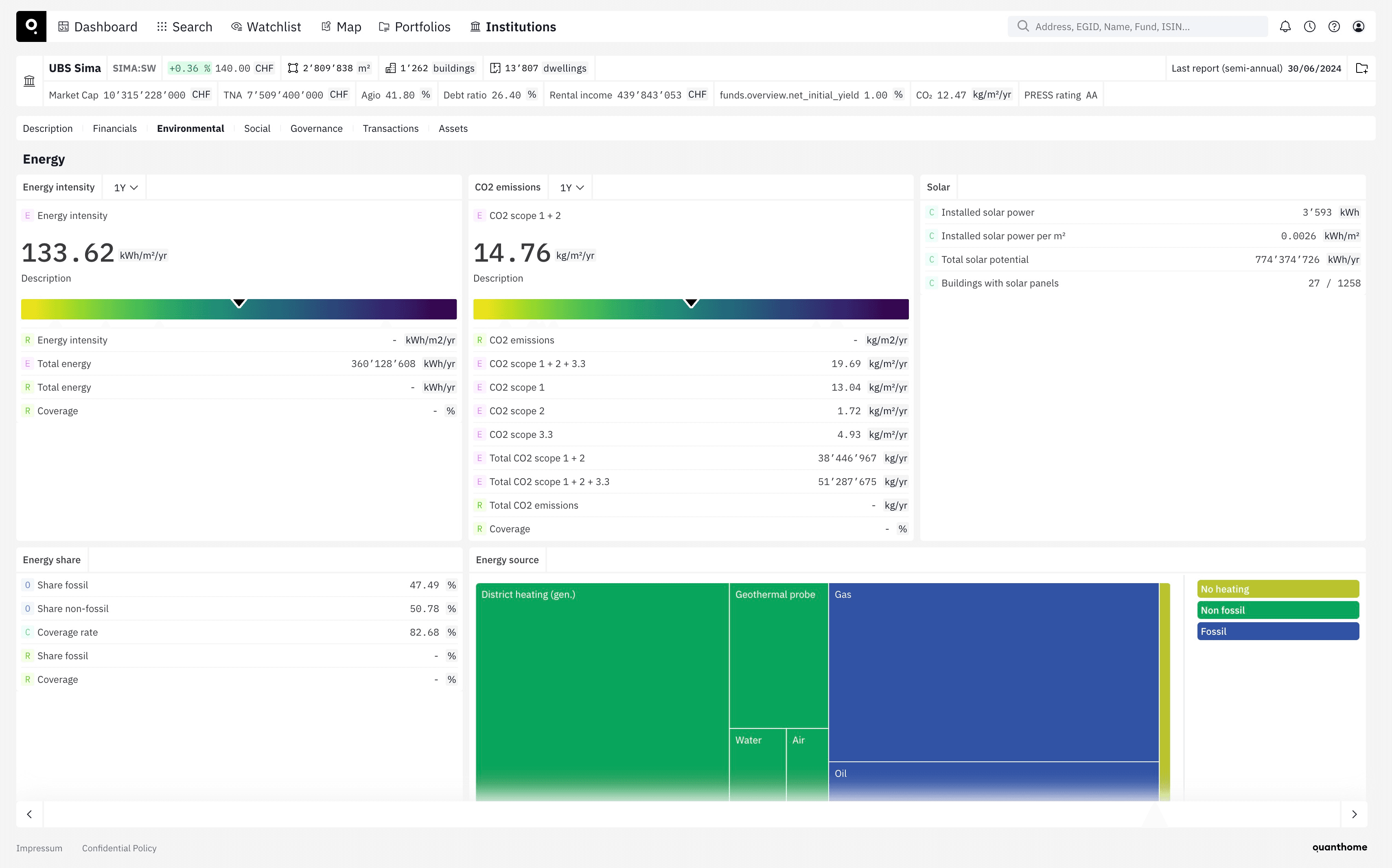

ESG & Impact investing

Evaluate CO₂ emissions for each property or portfolio and invest with a strong market opinion. Be at the edge of sustainable investing in real estate.

Auditing & Compliance

Cross-checking public and private sources, Quanthome speeds up data acquisition and aggregation.

Consulting & Advisory

Whether advising on renovations, governance or asset swaps, data plays a central role in ensuring the best due diligence.

Market research

& Sector analysis

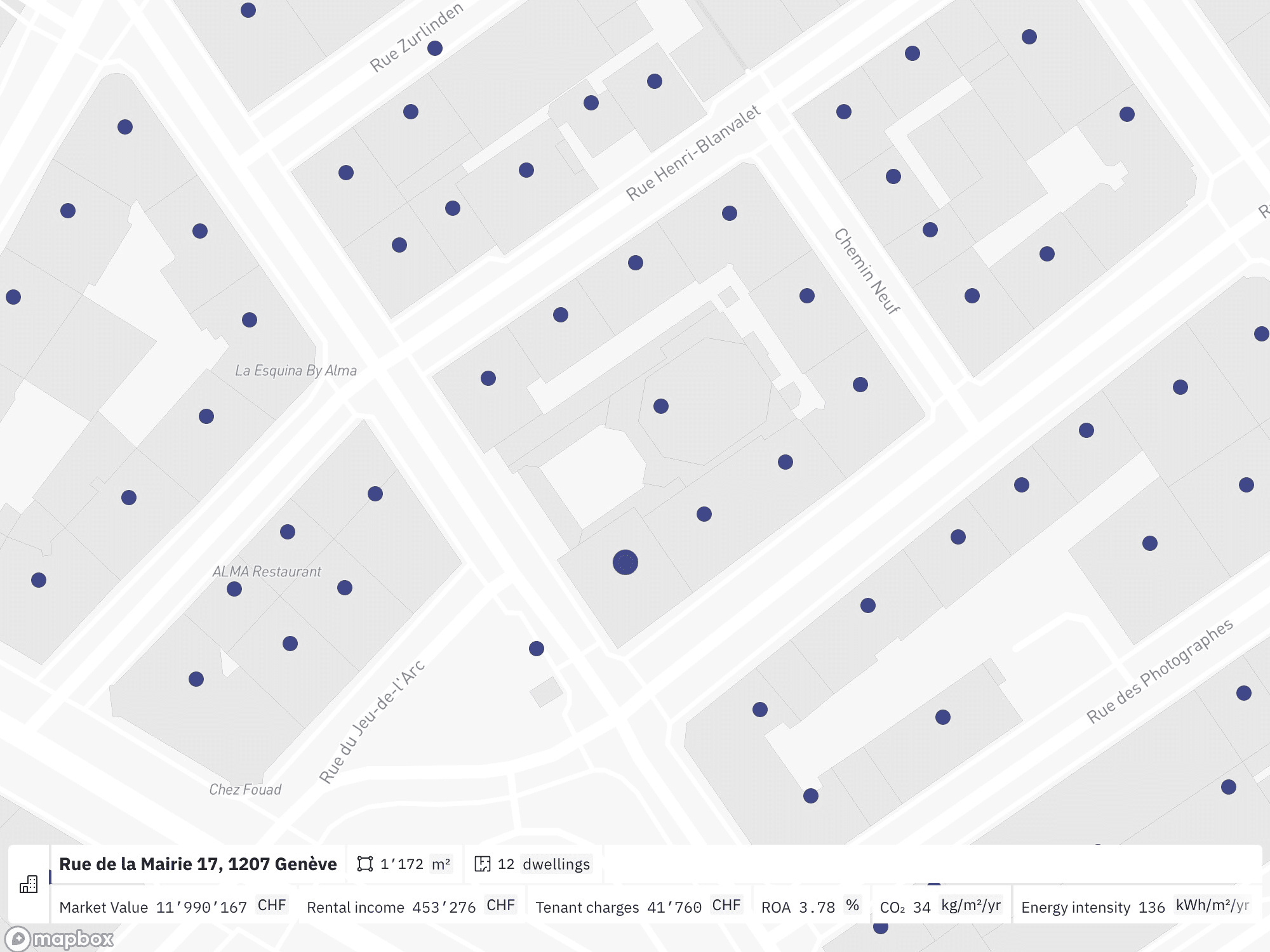

Compare buildings, cities, and cantons to uncover market trends and pinpoint the next booming markets.

Real Estate Acquisition

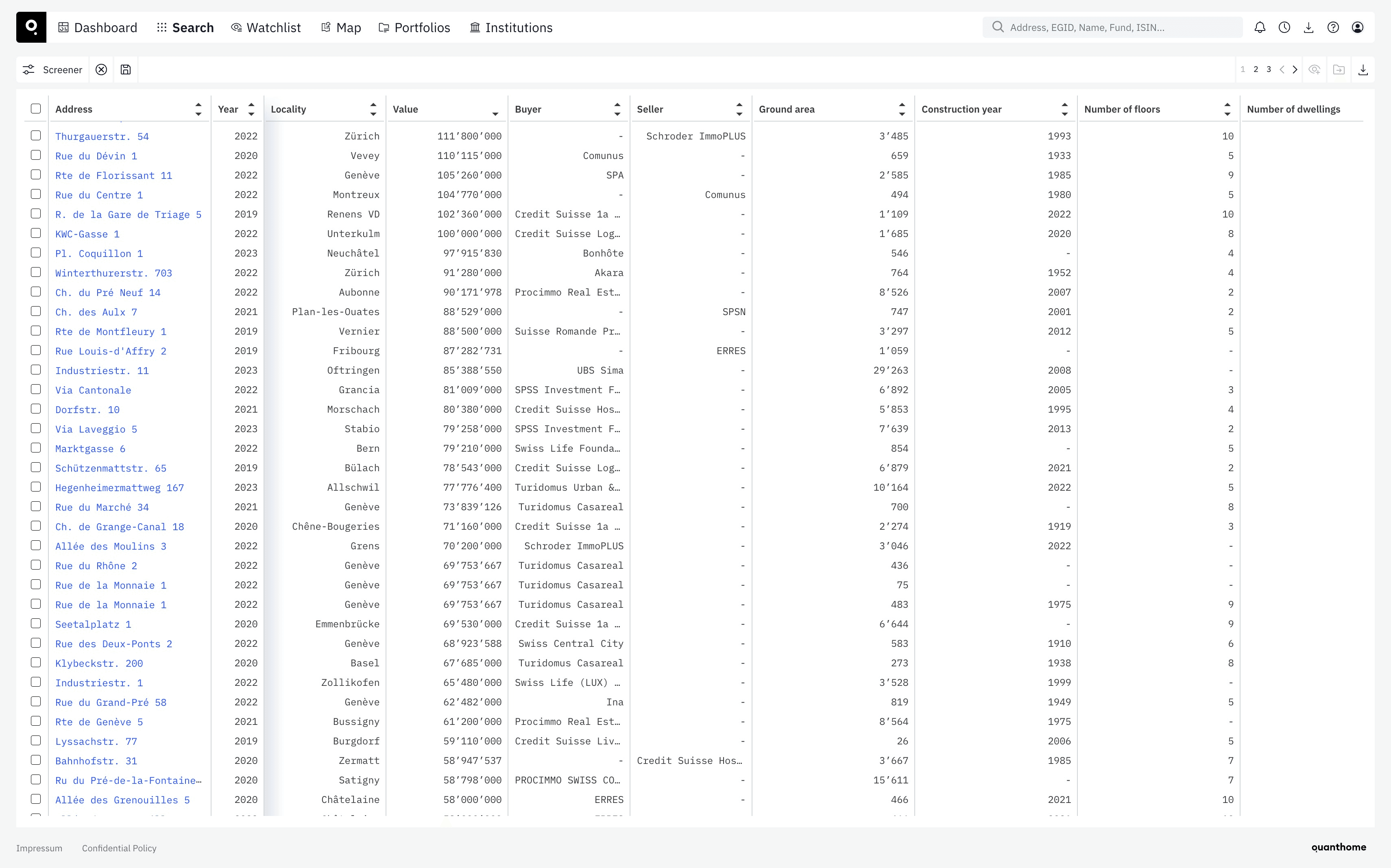

Analyse thousands of transactions and mortgages to identify arbitrage strategies and manage your risks.

Let's work together! Meet our team to discover unique solutions that address your specific needs.

Meet Quanthome